An E-bond is an encrypted file which provides the recipient with a secured and verifiable document (typically in PDF format) which is protected by security features.

An E-bond is an encrypted file which provides the recipient with a secured and verifiable document (typically in PDF format) which is protected by security features.

It takes less than 30 minutes to set up an account. We, however, recommend not waiting until the day before a bid; give yourself time to get familiar with the system; consider doing a test bond.

No. A scanned bond is a “picture” of a paper bond, which can easily be opened in a photo editing type of software that can then be potentially altered or changed. A scan of a paper bond may not be considered a legal document as it would not follow the industry's guidelines.

A proper E-bond must meet the following three threshold criteria:

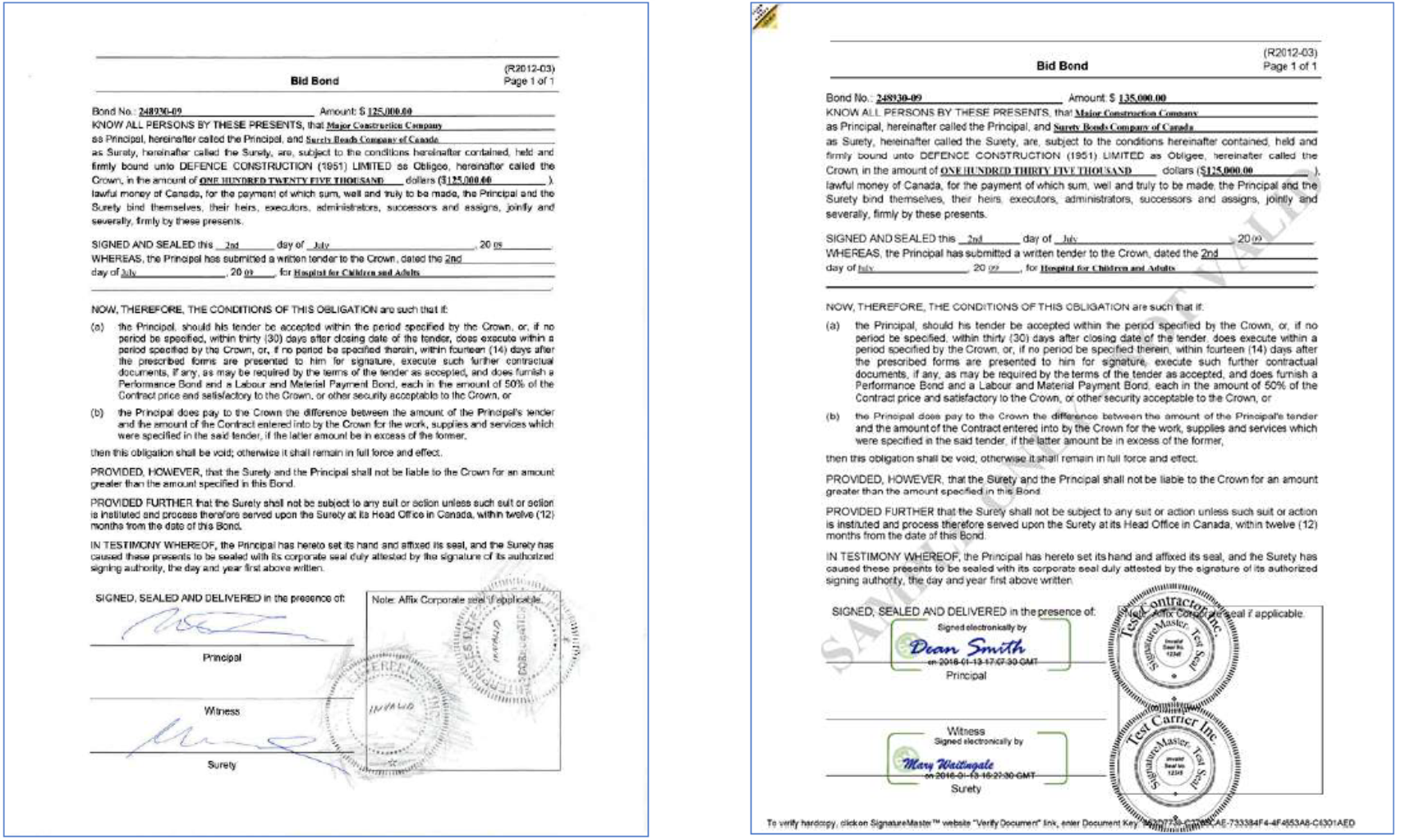

E-bonds typically contain a digital signature, a digital corporate seal and a verification tag or link to check that the bond document has not been altered.

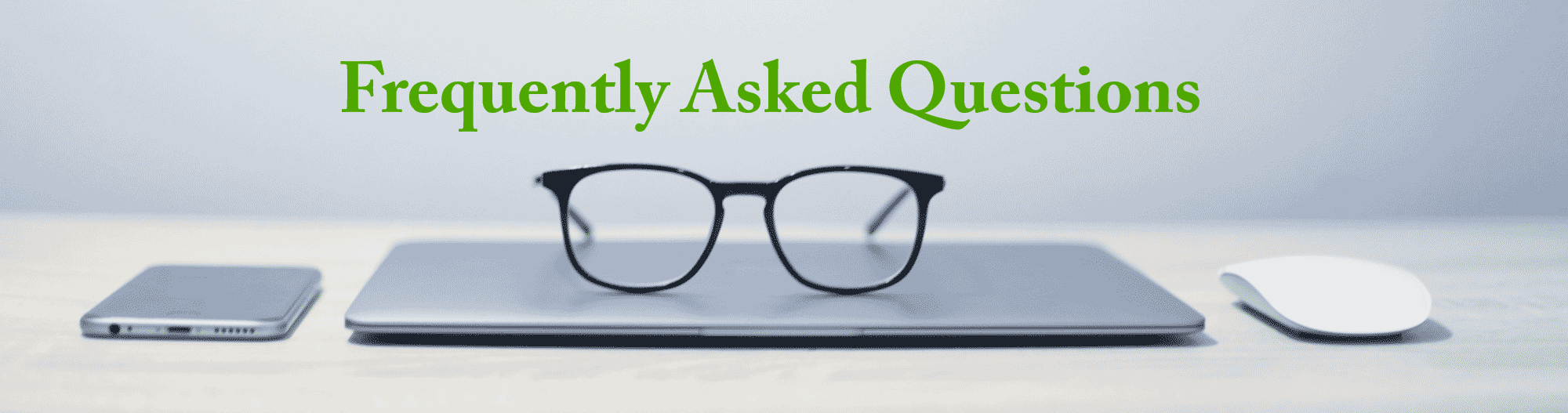

See samples below:

No. All the current software solution program providers that are listed on the SAC website (under Assessments) have the capability of creating Bid Bonds and final Performance and Labour & Material Payment Bonds.

Unlike normal contract documents, bonds are defined as deeds, hence, the courts have defined deeds (and thus bonds) as requiring to be:

In all Canadian provinces, except for the province of Quebec, an encrypted/secure/verifiable E-bond which includes a digital signature and corporate seal should follow the same guidelines as noted above.

For more details in this regard refer to the following on Surety Association of Canada's website:

Please have your broker contact an e-Bonding provider like Xenex Enterprises Inc. to get setup

Alternatively, some Surety Carriers will prepare the e-Bond for signing and sealing

The authorized signatories are the registered users but anyone can register them

The process of requesting is not changed. Just the signing and sealing steps become electronic

No, the Principal is still responsible for submitting the e-Bond as part of the Bidding process

Verifiable e-Bonds and related e-documents produced by e-Bonding solutions like Xenex’s SignatureMaster™ can be sent to Owners as email attachments

It is important to note that the process to accept E-bonds is rather seamless. E-bonds can either be uploaded to existing tendering platforms (i.e. MERX, bids&tenders, etc.) or can be sent via email as an encrypted/secure PDF.

The first step would be to contact a software solution program provider to discuss your requirements.

E-bonds are electronically verifiable for the life of the document, however, the definition of ‘life of the document’ would be defined in the specifications for bonding as outlined in the tender/project contract.

It is important to note, however, that the software solution program providers are not document storage facilities, so it would be the responsibility of the Owner to store and secure any E-bonds submitted or sent to them.

SAC has created a document that provides recommended language for owners to request/allow Electronic Bid Bonds (E-bonds). To download this resource for reference. CLICK HERE.

See Q&A under “General Questions” above.

There are several commercially available software programs capable of creating reliable and enforceable electronic bonds (E-bonds) that meet the criteria of the Surety Association of Canada.

SAC has reviewed and assessed e-bonding systems and copies of these assessments are available for review and download HERE.

It is recommended that Surety Brokers directly contact either of these software program providers to obtain more information.

Each software program provider determines their pricing and service offering, some offer flat fees, others offer pay-as-you-go pricing, etc. Our recommendation is to contact each provider directly to obtain more information to find the right solution for your needs and requirements.

Each software program provider determines their pricing and service offering, some offer flat fees, others offer pay-as-you-go pricing, etc. Our recommendation is to contact each provider directly to obtain more information to find the right solution for your needs and requirements.

Each Broker would be required to obtain Power of Attorney/Electronic Power of Attorney (e-POA) from a Surety in order to apply a seal on the Surety's behalf.

Most, if not all, Canadian Sureties already have their corporate seals loaded and available in each of the software program provider's systems.

Once a Broker registers and is granted access to the system, and have received confirmation from the Surety of the assignment of the e-POA, they can then use the corporate seal on any E-bonds that they create.

An Owner (Obligee) will advise a Contractor (Principal) that their bid submission was unsuccessful, however, in the E-bonding world an E-bid Bond may not get returned, so instead of waiting for the validity period to pass (i.e. 30, 60, 90 days, etc.), Brokers should suggest to their clients to contact them to advise that the tender was unsuccessful.

Once the Broker is made aware of the unsuccessful bid, they will relay the same message to the Surety so that whatever room that particular tender took up on a Contractor’s surety bond line can be freed up.

If you currently do not have a Broker or a relationship with a Surety, the first step would be to contact a Broker near you. CLICK HERE to access our on-line member Broker directory.

For contract surety bonds, generally, a business plan of your operations, references and financial statements would be required to be prequalified to obtain a surety bond (paper or E-bond). A Surety Broker can help guide you through the bonding process and will assist you in establishing a business relationship with a Surety company.

If you currently have a Broker and an existing relationship with a Surety, your Broker should be able to assist you in obtaining an E-bond. If, however, they are not currently set-up to produce E-bonds, please contact us at surety [at] suretycanada.com to let us know so we can reach out to them in this regard.

After the E-bond is digitally signed and a corporate seal has been added, it would simply be submitted based on the prescribed tender requirement, for example: emailed directly to the Owner (Obligee) or uploaded to an appropriate electronic tendering system (MERX, bids&tenders, etc.).

Note that the E-bond must be submitted as its own file and cannot be tampered or merged with any other files otherwise the Owner (recipient) will not be able to validate the E-bond.

Depending on the software program provider, some have the capability to produce digital signatures and/or seals directly in the tool, while others will refer you to a 3rd party platform (i.e. Presto Direct, Notarius, etc.) which creates a file that can be uploaded and affixed to the E-bond.

Since inception in 1983, the mission of Xenex Enterprises Inc. (XENEX) has been to 'Boldly Pursue the Ultimate in Business Innovation'. We focus on accelerating business productivity and simplifying life for organizations and people. Our robust cloud-based SaaS platforms enable organizations to quickly and securely digitize their entire business process, from document preparation to signing, sealing, authentication and managing authorities from anywhere, anytime and on any device. We are the go-to- solution provider for the Surety Industry in Canada.

Copyright © 2024 Xenex Enterprises Inc., All Rights Reserved.